The preferred stock journal entries below act as a quick reference, and set out the most commonly encountered situations when dealing with the double entry posting of preferred stock transactions. Of the preferred stock features noted here, the callable feature is less attractive to investors, and so tends to reduce the price they will pay for preferred stock. All of the other features are more attractive to investors, and so tend to increase the price they will pay for the stock.

Reporting mandatorily redeemable preferred stock

The call price might be the face or par amount plus one year’s interest or dividend. Understanding how to account for preferred stock is crucial for accurate financial reporting and compliance with accounting standards. This guide aims to provide a comprehensive overview of the various aspects involved in this process. The market price per share, on the other hand, refers to the per share value or worth at which a company’s stock is actually traded in the secondary market. Unlike par value, a stock’s market price is generally subject to frequent fluctuations and is largely determined by investors’ perceptions of the future of the stock and the operations of its issuing company. Preferred stock that can be exchanged by the holder for a specified number of shares of common stock of the same company.

Financial Accounting

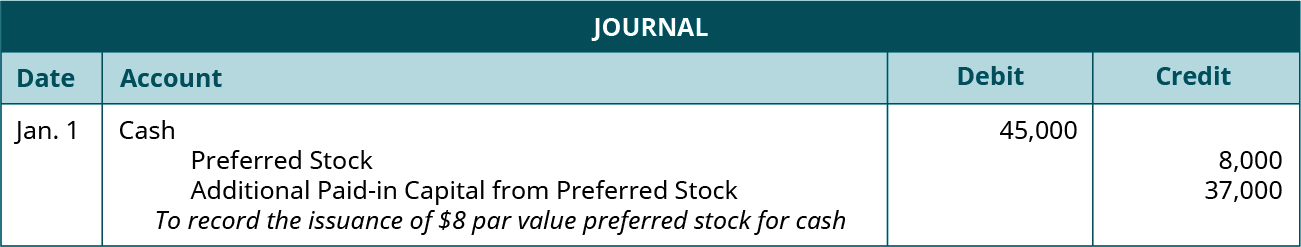

The issuance of preferred stock is accounted for in the same way as common stock. Par value, though, often serves as the basis for specified dividend payments. Thus, the par value listed for a preferred share frequently approximates fair value.

Convertible Preferred Stock Journal Entry

The basic difference between common stock and preferred stock lies in the rights and opportunities that a stockholder enjoys upon purchasing either of the two types of corporate stocks. David Enterprise issued 4,000 shares of common stock (par value $3 per share) upon conversion of 4,000 shares of preferred stock (par value $2 per share) that was originally issued at a premium of $0.3 per share. The main advantage of convertible preferred stock is that it allows the stockholders of such stock to retain preference dividends if the company is not doing well. Keep in mind your journal entry must always balance (total debits must equal total credits). Company A has $3,000,000 million issue of cumulative preferred stock comprising of 100,000 shares each carrying $3 dividend per annum. The company earned a profit of $200,000 in Year 1 and $500,000 in year 2.

- If the corporation receives more than the par amount, the amount greater than par will be recorded in another account such as Paid-in Capital in Excess of Par – Preferred Stock.

- Each share of common or preferred capital stock either has a par value or lacks one.

- The common and preferred are two different types of stock (also known as shares) that corporations issue to raise capital for their operations.

- The key difference between two convertibles is their distinct classification at the time of issuance.

Hello and welcome to Viewpoint

As an example, assume as before the business has issued the 1,000 7% preferred equity stock with a par value of 100 and an issue price of 105, but this time the stock is callable at 108. Each share of common or preferred capital stock either has a par value or lacks one. The corporation’s charter determines the par value printed on the stock certificates issued. Par value may be any amount—1 cent, 10 cents, 16 cents, $ 1, $5, or $100. While preferred stock mostly has a fixed percentage pay-off, in some cases it may have a component of payoff dependent on the profit of the company, such preferred stock is called participatory preferred stock.

Trial Balance

In the preceding illustration, the date of record might have been set as August 1, for example. To further confuse matters, there may be a slight lag of just a few days between the time a share exchange occurs and the company records are updated. As a result, the date of record is usually slightly preceded by an ex-dividend date.

Recall (from earlier chapters) that the Dividends account will directly reduce retained earnings (it is not an expense in calculating income; it is a distribution of income)! When the previously declared dividends are paid, the appropriate entry would require a debit motor vehicle sales and use tax to Dividends Payable and a credit to Cash. In some cases, preferred stock may include embedded derivatives, such as conversion options or call options. These features require separate recognition and measurement under accounting standards like IFRS and GAAP.

For instance, redeemable preferred stock, which the company is obligated to buy back at a future date, may be classified as a liability. This classification impacts the company’s debt-to-equity ratio, a key metric for assessing financial health. Accurate classification ensures that stakeholders have a clear understanding of the company’s financial obligations and equity structure. When dividends are declared, the company must consider the potential impact on the conversion ratio. If the preferred stock is converted into common stock, the company must reclassify the dividends from preferred to common equity.

This enables raising needed capital but preserves the ability to control and direct the company. While common stock is the most typical, another way to gain access to capital is by issuing preferred stock. The customary features of common and preferred stock differ, providing some advantages and disadvantages for each. The following tables reveal general features that can be modified on a company by company basis. To comply with state regulations, the par value of preferred stock is recorded in its own paid-in capital account Preferred Stock.